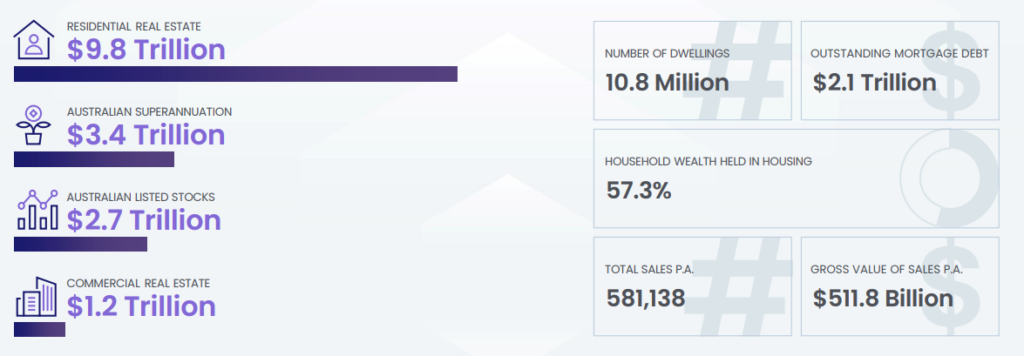

The Australian property market continues to be the principal asset class of choice for Australians with 57.3% of household wealth held in housing at a total estimated value of $9.8 Trillion. This is greater than the combined value of Australian Superannuation, Australian Listed Stocks and Commercial Real Estate.

Furthermore, with outstanding mortgage debt currently at $2.1 Trillion, the Australian Residential Real Estate market has a Loan to Value Ratio (LVR) of 21.4%. Contrary to many mainstream media headlines, the overall market's LVR is not what would be considered to be at critically dangerous levels.

According to CoreLogic, median dwelling values for the Australian property market in the 8 capital cities as at 31 August 2022 were as follows:

| Sydney | Melbourne | Brisbane | Adelaide | Perth | Hobart | Darwin | Canberra |

| $1 066 493 | $782 053 | $762 284 | $652 959 | $561 781 | $714 370 | $512 531 | $909 748 |

Whilst Sydney continues to have the highest median dwelling value, it is worth noting that despite having the 4th highest population of all the capital cities, Perth's median dwelling value ranks 7th overall. This is approximately 53% of the value of Sydney's median dwelling value, and a staggering $152 589 less than Hobart's median dwelling value which has approximately 10 times less than the resident population of Perth.

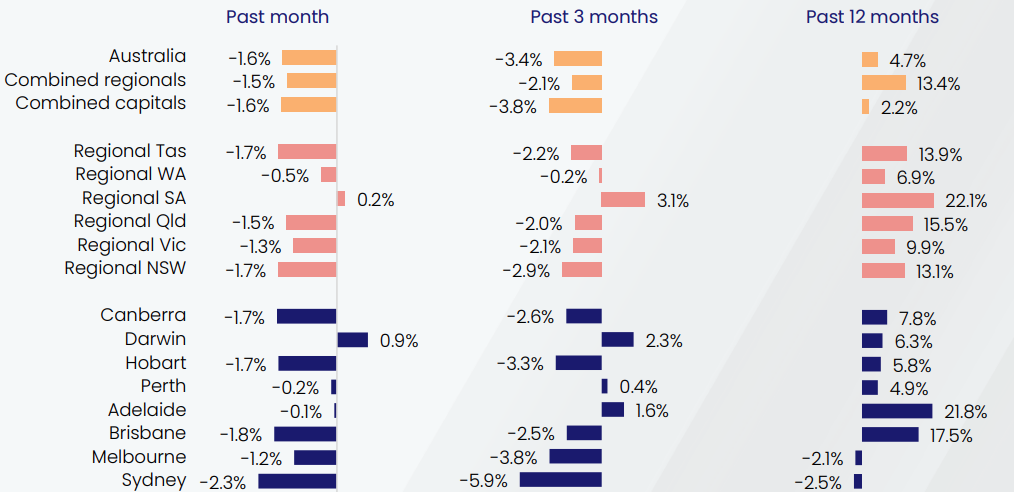

Combined regionals (1.5% decrease) outperformed combined capitals (1.6% decrease) during August 2022. The Regional South Australian (0.2%) market led the way. In the capital city market, Darwin (0.9%) continued its impressive recent run, whilst Sydney (-2.3%) and Brisbane (-1.8%) experienced the largest decreases in dwelling values.

Combined regionals (2.1% decrease) outperformed combined capitals (3.8% decrease) during the past 3 months to August 2022. The Regional South Australian (3.1%) property market was the top performer. In the capital city market, Darwin (2.3%) and Adelaide (1.6%) outperformed their peers, whilst Sydney (-5.9%) and Melbourne (-3.8%) both experienced a reduction in dwelling values over the quarter.

Combined regionals (13.4% increase) outperformed combined capitals (2.2% increase) during the past 12 months to August 2022. The Regional South Australian (22.1%) and Regional Queensland (15.5%) property markets recorded the highest levels of growth. In the capital city market, Adelaide (21.8%) and Brisbane (17.5%) were the standouts, whilst Sydney (-2.5%) and Melbourne (-2.1%) experienced decreases in dwelling values over the past year.

The Brisbane housing rental market continues to charge ahead with a 14.1% growth in rents over the past year. Adelaide (12.2%) and Sydney (9.8%) have also experienced substantial growth in rents for houses over the preceding 12 months.

The Darwin housing rental market has been more subdued, growing at 5.3% over the previous 12 months. Melbourne (5.7%) and Hobart (7.0%), although at the lower end of rental growth, are also seeing healthy increases in rents for houses.

The Melbourne unit market has outperformed all other capital cities, experiencing a 12.9% growth in rents over the past year. Continued pressure will be placed on this market as international borders continue to open globally and immigration returns to pre-pandemic levels. Sydney (11.6%) and Adelaide (11.1%) have also seen substantial growth in rents for units over the preceding 12 months.

Similarly to housing rents, Darwin has experienced more moderate growth of 5.0% in unit rents over the previous 12 months. Hobart (6.9%) and Perth (7.1%) have continued their annual increase, roughly in line with the economy's broader level of inflation.

Combined regional gross yields (4.2%) continue to be higher than combined capital gross yields (3.3%).

Regional Northern Territory (7.0%) and Regional Western Australia (6.1%) collectively have the highest regional gross yields, whilst Regional Victoria (3.6%) and Regional New South Wales (3.8%) have the lowest yields.

Amongst the capital cities, Darwin (6.2%) and Perth (4.4%) continue to offer the best opportunities for investors to purchase positive to neutrally geared property. On the opposite end of the spectrum, Sydney (2.9%) and Melbourne (3.0%) continue to offer the lowest gross rental yields.

Find the full version of the National Media Release by CoreLogic here.

You can find the Property Market Update for August here.